creating a small business isn’t straightforward. Building a modest business enterprise all through a as soon as-in-a-lifetime world-wide pandemic is near-unattainable. in addition to taking care of Competitiveness, marketing, financial management, staffing, and each of the other worries associated with functioning a company, businesses that operated through 2020 and 2021 faced the extra troubles of running a company even though confronting a complicated World wide web of government restrictions that limited business operations or, in some cases, shut corporations entirely.

To reward firms that retained workers as a result of this tough interval, the Federal govt set up the worker Retention Tax credit history, a refundable credit for corporations that ongoing to pay workforce through 2020 and 2021. Securing this credit can help companies even now recovering from your pandemic and be certain their continued operations and viability. Additionally, your small small business may qualify for an ERTC progress bank loan, a way to be sure that your business has the ready money to fulfill your obligations and benefit from chances for growth.

What Is The ERTC?

The Employee Retention Tax credit score (also known as the “ERTC” or “ERC”) is a refundable tax credit for firms that continued to pay their personnel all through government shutdowns and slowdowns in small business occasioned by the COVID-19 pandemic. The ERTC was launched as part of the Coronavirus support, aid, and financial safety (“CARES”) Act in 2020. The ERC has since been amended 3 individual situations: in March of 2020 by the Taxpayer Certainty and catastrophe Relief Act of 2020 (“Relief Act”), the American Rescue program (“ARPA”) Act of 2021, as well as Infrastructure financial commitment and Employment Act (“IIJA”), also in 2021.

The ERTC provides qualified companies that has a credit score against particular employment taxes. suitable businesses contain anyone who has seasoned an entire or partial suspension of operations as a result of government orders relevant to COVID-19, or a substantial decrease in gross receipts.

For 2020, the ERTC was accessible for fifty% with the wages paid out nearly $10,000 for each staff, capped at $5,000 for each personnel. For wages paid following January one, 2021, and prior to Oct one, 2022, the ERTC is usually placed on 70% of qualifying wages of approximately $ten,000 for each quarter — a optimum of $28,000 for every employee via September thirty, 2021.

experienced wages involve wages and overall health program fees compensated to qualified personnel among March twelve, 2020, and December 31, 2021. Eligible workers contain individuals who were retained and paid out during a qualifying period, irrespective of whether they had been actively Operating or not.

exactly what is An ERTC progress?

An ERTC progress (also referred to as an ERTC Bridge or an ERTC bank loan) is a brief-expression financial loan which is utilized to make the money from your pending application for your ERTC available to your small business immediately. An ERTC more info Advance can be certain that your company has the ready money to work and thrive, and eliminates the necessity to wait for presidency acceptance of your respective software although your application is pending.

when there is no Formal timeline for IRS processing of ERTC purposes, processing and acceptance of promises can normally choose 8-12 months. This lengthy processing time can indicate that cash owed to firms are delayed for months, if not in excess of a calendar year. Securing an ERTC progress can make sure cash can be found straight away.

However, securing an ERTC Advance loan isn't devoid of danger — an software that may be denied by The interior earnings services in whole or partially might allow it to be tricky to repay an ERTC progress. The ERTC is complex. as a result, it’s essential that companies wanting to protected an ERTC Advance make certain that their software is as extensive and airtight as feasible in advance of securing financing of the ERTC claim. making certain that your assert continues to be evaluated by skilled industry experts and is also backed by lawful exploration and comprehensive review can provide security and peace-of-thoughts as your compact business pursues its claim. At ERTC Funding, we carefully evaluate and critique your claim, making certain the funds you apply for are classified as the resources you’ll acquire.

What Can An ERTC progress financial loan Do For Your compact company?

the flexibleness of the ERTC progress bank loan offers a selection of benefits for a little business. An ERTC Advance personal loan can increase predictability and balance to your organization’s income flow, making sure that your organization has each of the funds you require to work on a day-to-working day basis, with no demanding you to definitely look ahead to the vagaries of government processing of statements.

An ERTC Advance bank loan might also enable your company benefit from opportunities since they occur, allowing for you to purchase out a competitor, acquire inventory at a reduction, or extend your business with your timeline, not The federal government’s.

How ERTC Funding may also help

ERTC Funding is your husband or wife at every single phase in the ERTC software approach. Our proficient, seasoned workforce of gurus will thoroughly assess your assert to ensure you qualify for the utmost refund doable, comprehensive your IRS submitting, and operate with our community of partners to uncover you the best possible ERTC Advance personal loan for your company. your small business can qualify to finance your accepted ERTC claim in as minor as a person to two weeks, guaranteeing that your company receives the funds it’s entitled to over a timeline that actually works for your organization.

Uncertain If your enterprise Qualifies?

The ERC is a complex software, and lots of companies are Doubtful whether or not they qualify – Specifically In terms of examining partial suspensions of operations. Fortuitously, ERTC Funding is in this article to aid! We’ve assisted lots of purchasers with deciding their eligibility to claim the ERC based on complete or Partial Suspension of functions (FPSO), a major Decline in Gross Receipts (SDGR), or as a Recovery Start-up enterprise (RSB) – and we might enjoy that may help you!

ERTC Funding’s (ertcfunding.com) ERC specialists, tax authorities and lawful counsel may help Appraise whether your organization qualifies for the ERC and assist with the claiming approach. Our proprietary ERC allocation/optimization software package may assistance make sure that, if your organization is eligible, no accessible funds are left about the table! As an added bonus, mainly because of the quite often-considerable delays in IRS processing of ERC statements, ERTC Funding also offers upfront financing options Which may be obtainable if your enterprise requirements The cash now.

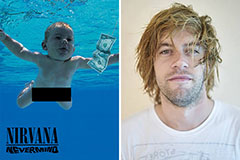

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!